Types of insurance

An in-depth guide to the different types of insurance policies in India

Unplanned expenses in life are the harsh reality of life. Even if you believe you’re financially secure an unexpected or unplanned expense can seriously undermine your security. Based on the severity of the crisis, these events could leave you with debt.

Although you can’t plan ahead to deal with the consequences of the occurrence of such events insurance policies can provide an element of assistance to limit financial risk in the event of an unexpected incident.

There are a variety of insurance plans, each is designed to safeguard specific aspects of your assets or health.

There are 8 kinds of insurance, including:

- Life Insurance

- Motor insurance

- Health insurance

- Insurance for travel

- Insurance for property

- Mobile insurance

- Cycle insurance

- Bite-sized insurance

Just knowing about the various insurance policies will not assist. You must be aware of how these plans function.

If you don’t have the right knowledge of the various policies in the first place, you might not be able protect your money and the financial security that your loved ones. Learn everything you should know about different insurance policies.

1. Life Insurance

Life Insurance refers to a policy or cover that ensures the policyholder is able to provide financial security for their family members upon the death of. If you are the sole earner in your family, and you are responsible for both your children as well as spouse.

In this scenario the loss of your income would ruin the entire family. Life insurance policies guarantee that this will not occur by providing financial aid to your family should you pass away. death.

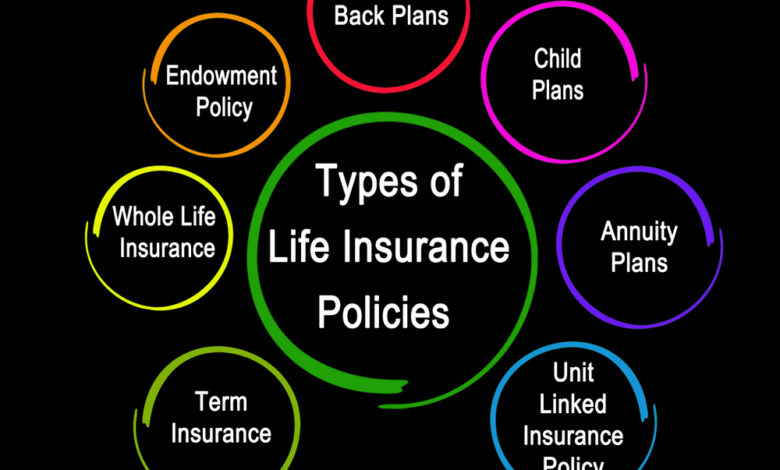

Types of Life Insurance Policies

There are generally seven kinds of insurance policies available when it concerns life insurance. They include:

- term plan – Term Plan-The death benefit of the term plan is only applicable for a certain time like 40 years after the date of the policy purchase.

- Endowment Plans The endowment plan is a type of life insurance policy in which the premiums will go towards an inheritance benefit upon death, and the rest is put into the account of the insurance company. Benefits for maturity, death benefits along with periodic rewards are just a few types of aids that are available through endowment plans.

- Unit Linked Insurance Plans or ULIPs– ULIPs-Similar to the endowment plan where a portion of the premiums you pay for insurance are put to mutual fund investments and the remainder goes to your death benefits.

- Whole Life Insurance– Whole Life Insurance-As the name implies these policies provide insurance for the entire life of an individual instead of a specific time period. Certain insurers might limit the entire life insurance period to a maximum of 100 years.

- Children’s Plan Child’s Plan Child’s Plan HTML0Investment the cum policy of insurance which will provide financial support for kids throughout the course of their life. The death benefit can be accessed as a lump sum payment following the death of the parents.

- Cash-back– The policy is calledSuch policies cover a set portion of the amount that is guaranteed after regular intervals. This is referred to as a the survival benefit.

- Pension Plan The HTML0 Retirement Plan Retirement Plan-Also called pension schemes, these policies combine insurance and investment. Part of cost go towards creating an investment fund for retirement for the policy holder. It is offered in the form of a lump sum or monthly installment following the time the policyholder has retired.

Benefits of Life Insurance If you own life insurance and you are a member of the policy, you will benefit from the following benefits of the policy. Tax benefitsTax Benefits Tax Benefits-If you pay premiums for life insurance and you qualify for tax advantages in India in accordance with section 80(C) as well as 10(10D) in the Income Tax Act. This means that you could save substantial amounts of money in taxes when you choose an insurance policy that covers life. encourages saving habits It encourages saving habit It encourages saving habitsSince you have to pay for premiums on your policy purchasing an insurance policy encourages the practice of saving money. Protects the financial future of your familyIt is It’s a way to ensure your family’s financial futureThe policy guarantees the financial security of your family remains intact even after your death. helps you plan your retirement The Helps Plan Your Retirement Helps Plan Your Retirement-Certain policy types of life insurance can also are investments. For example pension plans can provide an instant lump-sum payout as you retire, which helps you fund your retirement. After you’ve learned all regarding life insurance policy, read through to discover the many aspects of the other general insurance policies.

2. Motor Insurance

Insurance for motor vehicles is a term used to describe policies that provide financial assistance in the event of an accident which involve your vehicle or bicycle. Motor insurance is available for three types of motorized vehicles, which include:

- Car InsuranceThe policy covers The policy covers car insurance.Personally owned four-wheelers are covered by this policy.

- Two-wheeler InsurerTwo-wheeler Insurance Two-wheeler InsurancePersonally owned two-wheeler automobiles, like scooters and bikes, are covered by these plans.

- Commercial Vehicle Insurance– Commercial Vehicle InsuranceIf you have a vehicle employed for commercial purposes, you should to get insurance for it. These policies will ensure that your company vehicles are in good condition which reduces the amount of loss.

Types of Motor Insurance Policies

In relation to the amount of coverage or protection provided, motor insurance policies can be classified into three kinds that are:

- Third Party Liability Third-Party Liability HTML0 – This is the simplest type of motor insurance in India. This is the minimal compulsory obligation for all motor automobile owners as stipulated by the Motor Vehicles Act of 1988. Because of the insufficient financial aid, the premiums for these policies are also likely to be very low. They only cover the financial obligation to the person who was a victim of the incident, making sure that you are not liable for legal trouble due to the incident. However, they don’t offer financial aid to repair the vehicle of the policyholder after an accident.

- Comprehensive Coverage Comparatively to the third party liability option, comprehensive insurance plans provide better security and protection. In addition to covering third party liability as well, these plans pay for expenses associated with repair of damage to the insured’s vehicle in the event of an accident. In addition, comprehensive plans include a guarantee of a payment in the event your vehicle is damaged from fire, human-caused and natural disasters as well as riots and other situations. Additionally, you can claim the cost of your vehicle should it be stolen with a comprehensive insurance policy in place. You can also choose to include additional options with their comprehensive motor insurance policy to enhance the overall coverage. These add-ons can include zero depreciation insurance as well as protection for the engine and gearbox cover, consumable coverage and breakdown assistance, among others.

- Personal Damage Insurance It is a specific type of motor insurance that insurance companies provide to customers. Furthermore, you’re eligible for this plan only if you bought the car or two-wheeler on or after September 18, 2018. The car must be new and not an old one. It is important to be aware that you are able to benefit from this individual own damage coverage just if have a third-party automobile insurance coverage that covers liability. With your own damage insurance you will basically get the same benefits of a full-coverage policy, without the third party liability portion that is included in the coverage.

Benefits of Motor Insurance Policies

The cost of bikes and cars is becoming more expensive each day. As a result the absence of insurance could result in severe loss of money on the part of the owner. Below are some benefits of buying a policy.

- Eliminates Legal HassleIt also Legal Hassle-Helps you avoid penalties for traffic violations and other legalities you’d otherwise have to deal with.

- meets all third-party liability requirements If you cause injury to the person you are hurting or damage their property as a result of a motor vehicle accident and the insurance policy assists to compensate for the financial loss, effectively.

- Financial Assistance for Repairing Your Own vehicleThen HTML1After accidents, you will need to shell out a significant amount for fixing your vehicle. Insurance plans help limit these expense out of pocket and allow you to make repairs right away.

- Insurance for loss or theftIn the event that your vehicle is stolen and your insurance policy is canceled, it will assist you in reclaiming part of the bike’s cost on the road. You will also receive similar help in the event that your vehicle is damaged beyond repair because of incidents.

In addition, people with a business car or two-wheeler may also benefit from tax deductions when they pay for the insurance premiums of the car.

3. Health Insurance

health insurance is a form of general insurance that offers financial aid to policyholders in the event that they receive hospital admission to receive treatment. Furthermore, certain insurance plans offer coverage for the cost of treatments that is carried out at home prior to hospitalization or after the discharge from the hospital.

Due to the increasing medical cost in India the purchase of health insurance is now an essential requirement. But before making purchasing, you should consider the various health insurance plans in India.

Different types of health Insurance policies

There are eight major kinds of insurance for health that are available in India. They include:

- Individual Health InsuranceIndividual Health Insurance Individual Health InsuranceThese are health plans that provide medical insurance only to one policy holder.

- family Floater Insurance– HTML1These policies permit you to get health insurance coverage for the entire family members without the need to purchase individual plans for each member. Generally, spouse, husband and their two children can get health insurance in one family floater plan.

- Critical Illness Coverage The HTML0 Critical Illness Cover are specific health insurance plans that offer an extensive amount of financial aid in the event that the person who is insured is diagnosed with certain chronic, long-term illnesses. They offer a lump-sum settlement following the diagnosis, which is not the case with traditional healthcare insurance policy.

- Senior Citizen Health Insuranceas the name implies these policies cater to people who are 60 and above.

- Group Health InsuranceThese policies are typically provided by employees in an organization or business. The policies are created in that beneficiaries who are older can be eliminated, and new beneficiaries may be added, based on the capacity of retention for employees in the company.

- Maternity Health InsuranceThe policies cover medical costs during pregnancy, post-natal and post-delivery phases. It covers the mother and her baby.

- Personal Accident Insurance– Personal Accident InsuranceThese personal accident insurances provide financial protection from the risk of accidents, disabilities or deaths that result from accidents.

- Preventive healthcare planThe policies will provide coverage for the costs of treatment that focuses on preventing the onset of a serious illness or health condition.

Benefits of Health Insurance

After reviewing the different kinds of health insurance plans available it is likely that you are wondering what the reason why having a health insurance plan is crucial for your family members and you. Take a look at the reasons below to discover the reason.

- Medical ProtectionMedical Coverage HTML0 Medical Coverage –The principal benefit of this insurance is that it provides insurance against medical expenses.

- cashless claimIf you need medical treatment in one of these hospitals with agreements with your insurance company you are eligible for of the cashless claim benefit. This option ensures that medical expenses are settled directly between your hospital and your insurer.

- Tax BenefitsPaying health insurance premiums are eligible for tax-free income. In Section 80D of the Income Tax Act one can get a tax benefit that can be as high as Rs.1 Lakh on the premium paid for medical insurance policy.

There are other advantages in accordance with the insurance company that is involved.